Insights & Updates

Latest from Tattle

Discover trends, tips, and insights to elevate your restaurant operations.

Discover trends, tips, and insights to elevate your restaurant operations.

Editors note: Due to the exclusive and sensitive insights and data, the pizza brand featured in this article has requested anonymity. They will be referred to as Crust and Co.

Executives at Crust and Co. asked themselves the following question: “Is there a better way to analyze and understand the performance of our of Limited-Time Offers (LTOs) throughout the year?”

They asked this question because they noticed their LTO process generally followed the same pattern: Ideate, launch, and hope. This process was void of any true insights and optimization.

In fact, the only data-backed element of this process was in sales data — but even that didn’t say much, especially since there were no previously-launched LTOs that stood apart from the permanent menu.

This moved Crust and Co. to seek out not only a deeper understanding of what customers thought about their LTOs, but a way to collect those insights in an organized, real-time, and scalable manner.

Here is the formula they came up with and the results…

Crust and Co. is launching a new Pizza By The Slice LTO item that has three variations: BBQ Bonanza, Fig and Feta, and Pesto Pizzazz.

Capture between-meal traffic with individual pizza slices. It’s designed for quick consumption and looks to generate more revenue outside of the company’s core dinner daypart.

If successful, Crust and Co. may add this LTO to the permanent menu.

Generate a significant amount of social media buzz that attracts both new and existing guests.

Crust and Co. is looking for this LTO to boost the sales of other menu items, ultimately converting more visitors into loyal fans with a higher LTV.

Guest sentiment data is immediate, direct, and informative. It reveals whether an item is well-received and likely to generate greater sales, return visits, and satisfaction down the line.

Crust and Co. will measure sentiment using Tattle’s automatic and proprietary surveys. The causation-based format breaks down each operational category (e.g. Food Quality, Speed of Service, Accuracy, etc.) into underlying factors (e.g. Texture, Taste, Temperature, etc.). These surveys have a 94% completion rate.

– Perceived Value – Order Accuracy – Level of customization – Likelihood to re-order – Likelihood to recommend – Reasons for ordering – How they heard about the new item

Throughout the data collection period, Crust and Co. will closely monitor the survey completion rate to ensure both quality (i.e. level of detail of the survey) and quantity (i.e. statistical significance) of the data.

Typically, within just a few weeks, Tattle would have already collected statistically-significant data to make early conclusions on.

The following graphs will show you how Tattle analyzed the previously-mentioned metrics and survey questions to find actionable insights for Crust and Co.

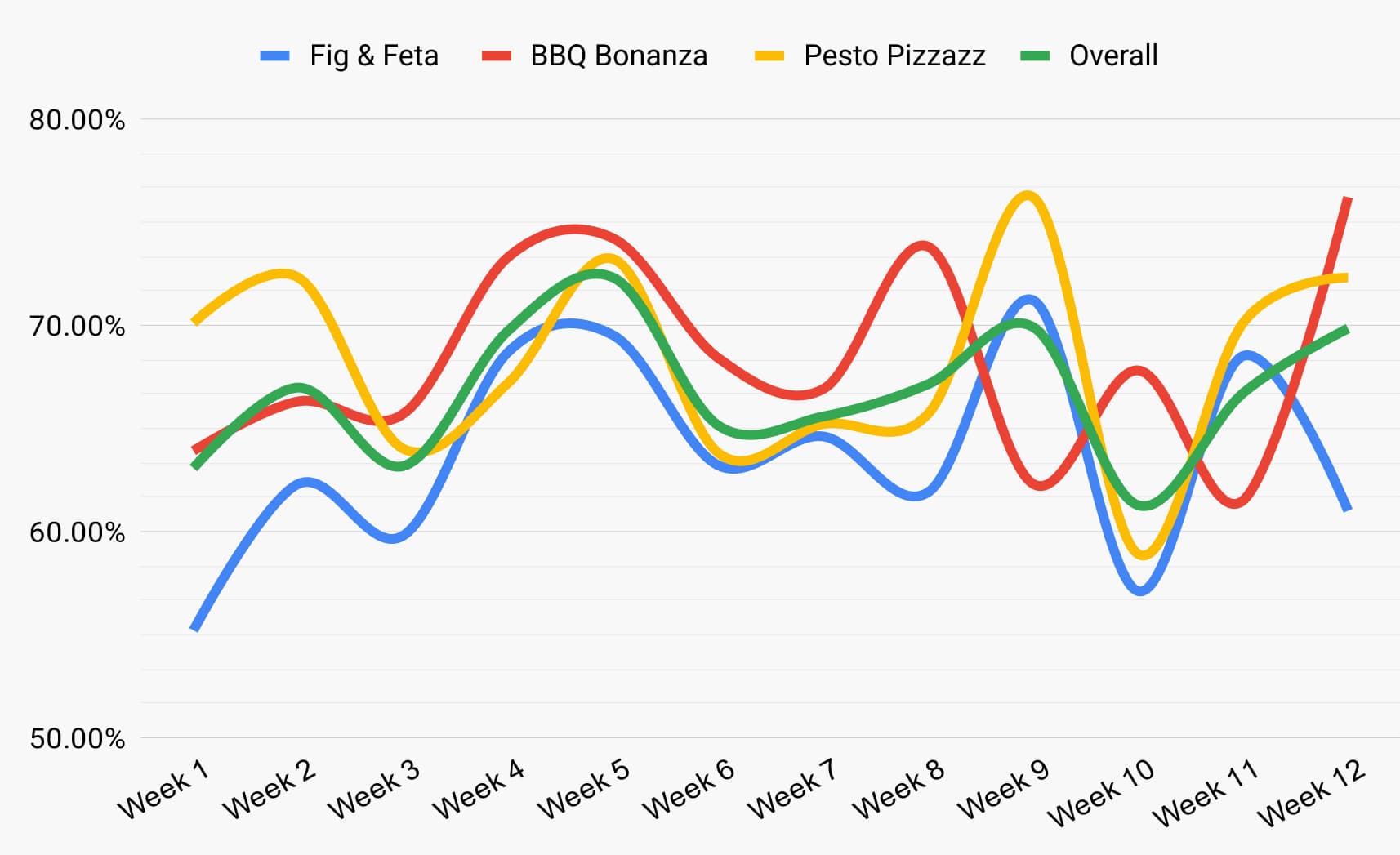

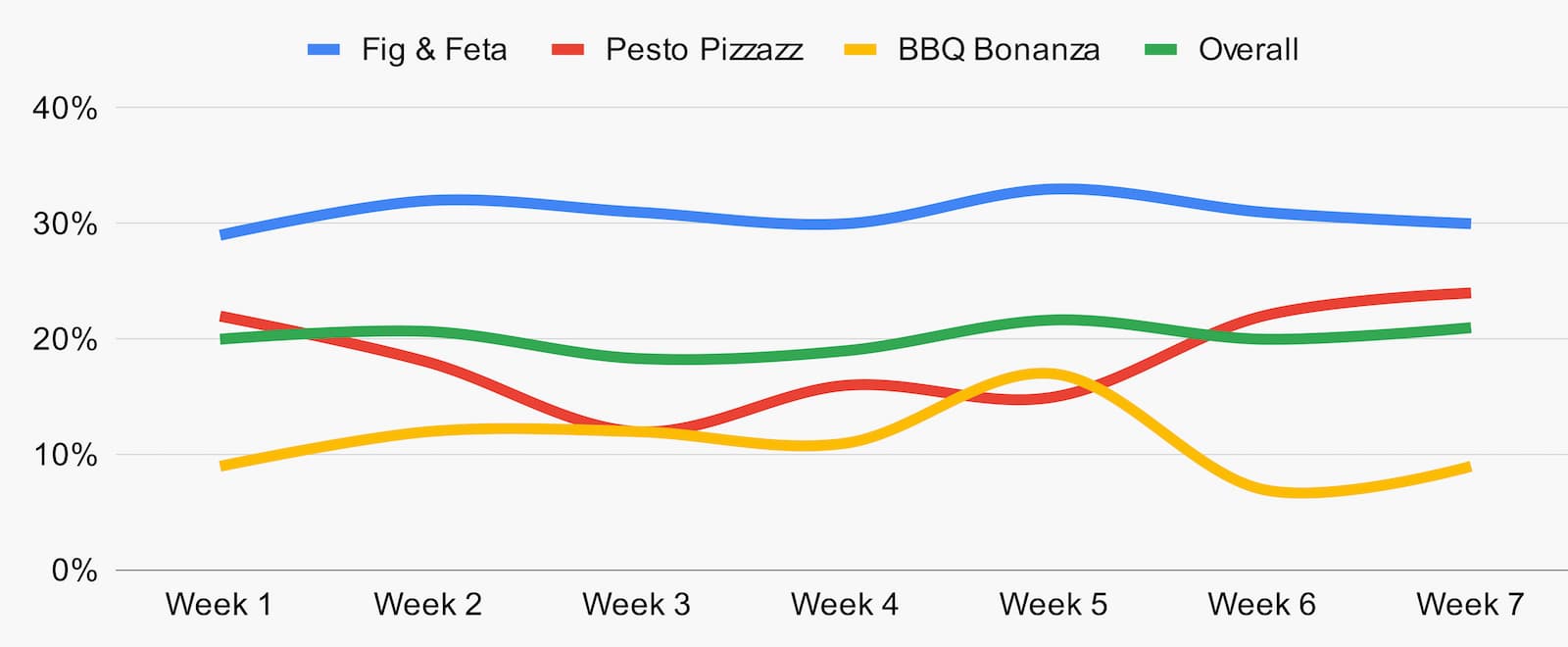

Based on the survey results, we break down the satisfaction scores for each LTO variation, as seen in the chart below.

While the LTO as a category saw consistent OSAT through the promotion period, BBQ Bonanza had the highest satisfaction.

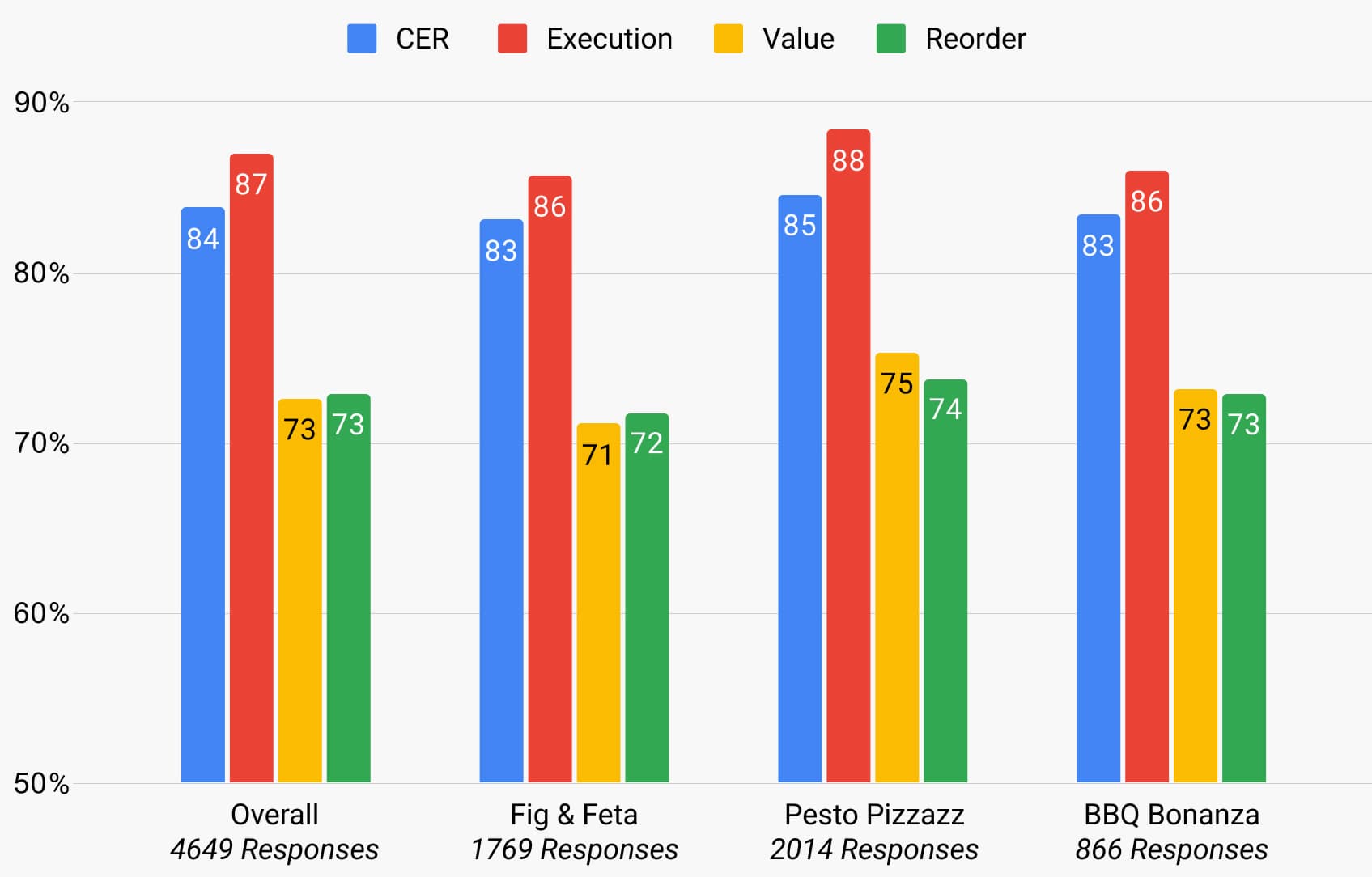

Overall, guests were relatively satisfied with the execution of the LTO, indicating a higher satisfaction in “Execution” than “Value”.

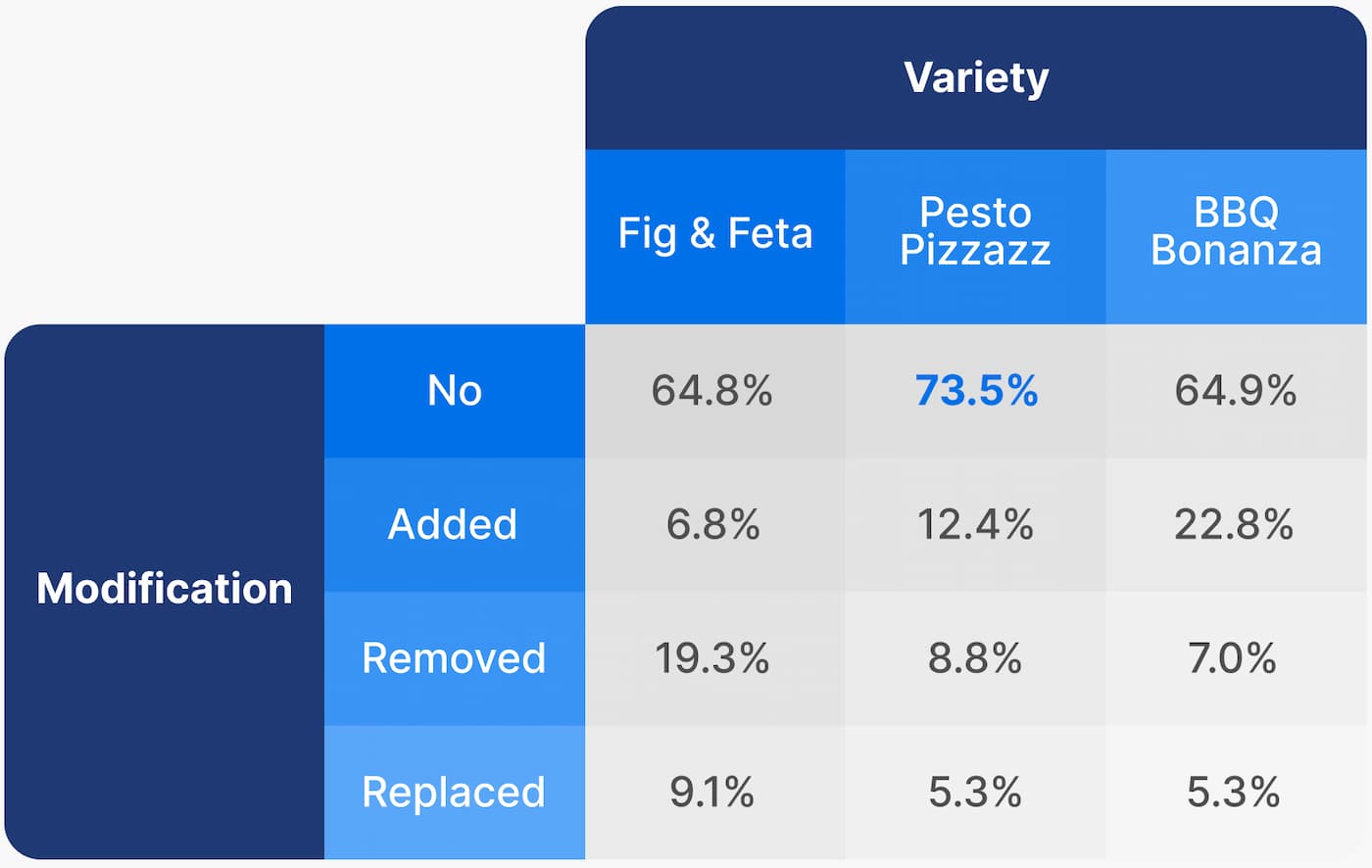

It’s important to measure the operational complexity of LTOs. Of all the three variations, Pesto Pizzazz is the least likely to be modified, whereas Fig and Feta is the most likely to be modified.

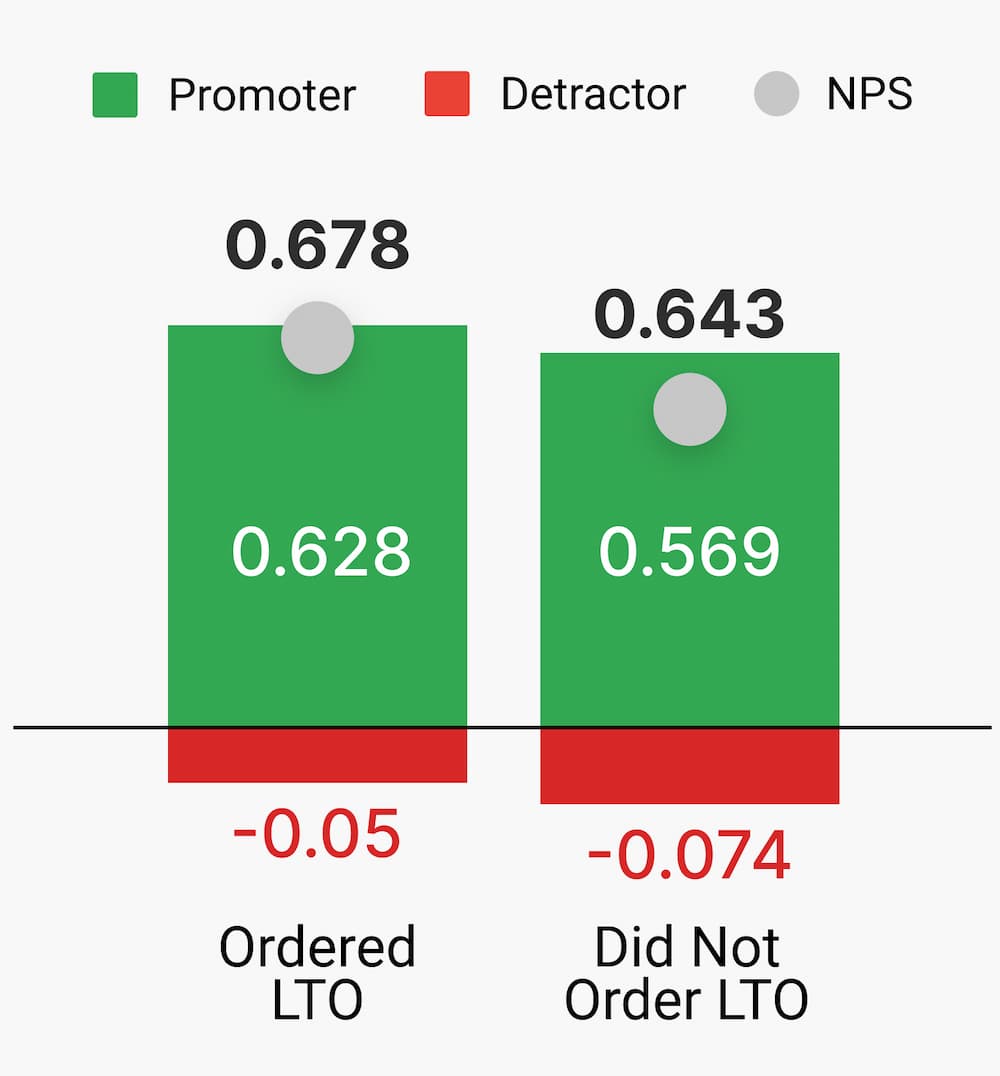

Guest’s Willingness To Recommend

In addition, guests who ordered the LTO were 5.9 ppt more likely to promote Crust and Co. to friends than those who didn’t order an LTO, which is a fantastic outcome.

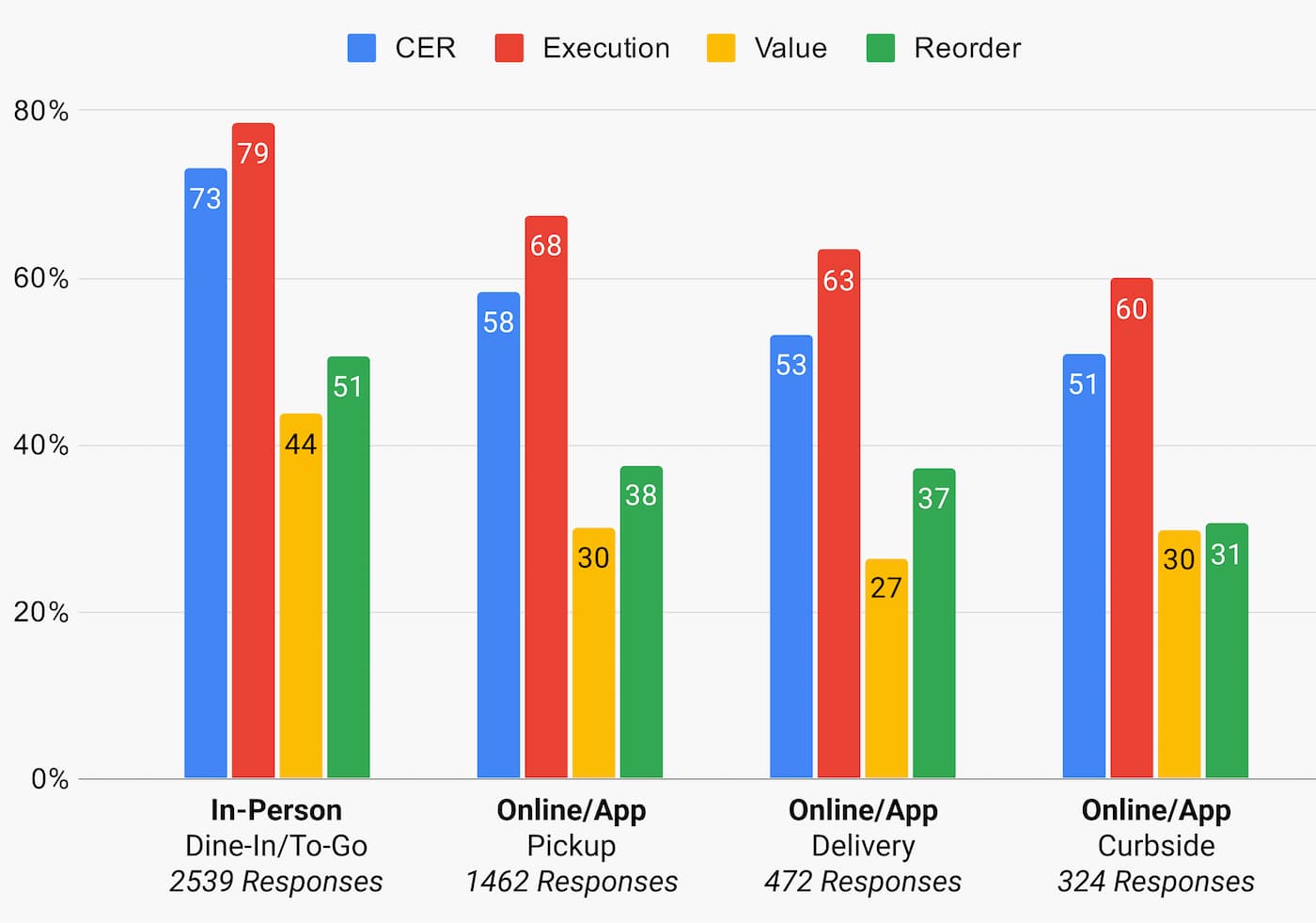

In a breakdown by journey, it’s clear that LTO performance is the highest on-premise, and lowest for curbside orders. With that said, for all off-premise channels (pickup, delivery, curbside), satisfaction is similar across overall Customer Experience Rating (CER), value, and execution.

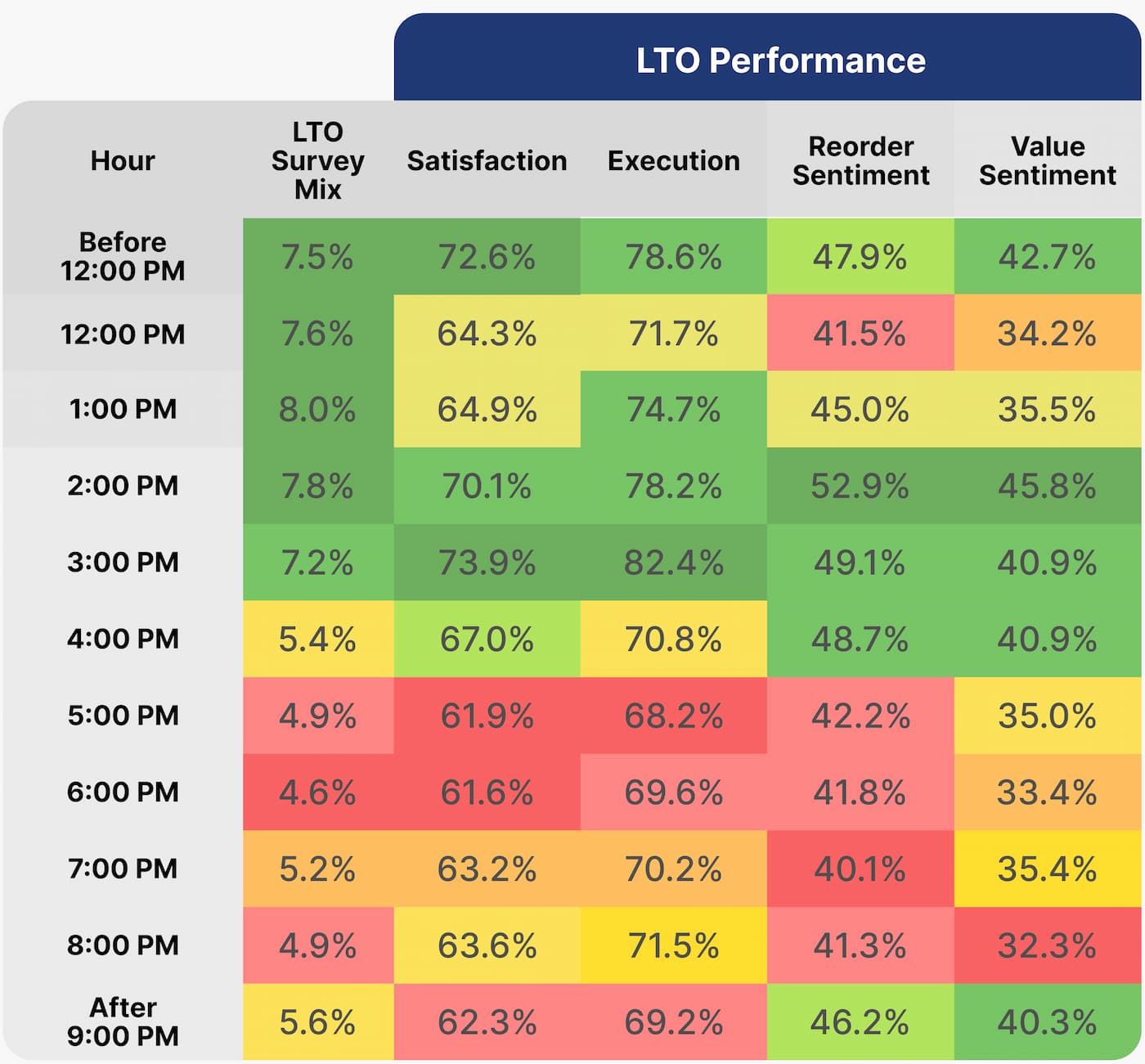

Based on the table above, it’s clear that the LTO’s survey mix is the highest before 3:00 pm, which shows that guests indeed view the new “Pizza By The Slice” as a lunch or snack item.

In addition, guest satisfaction tends to be higher during that same period of time, with performance declining past 5:00 pm.

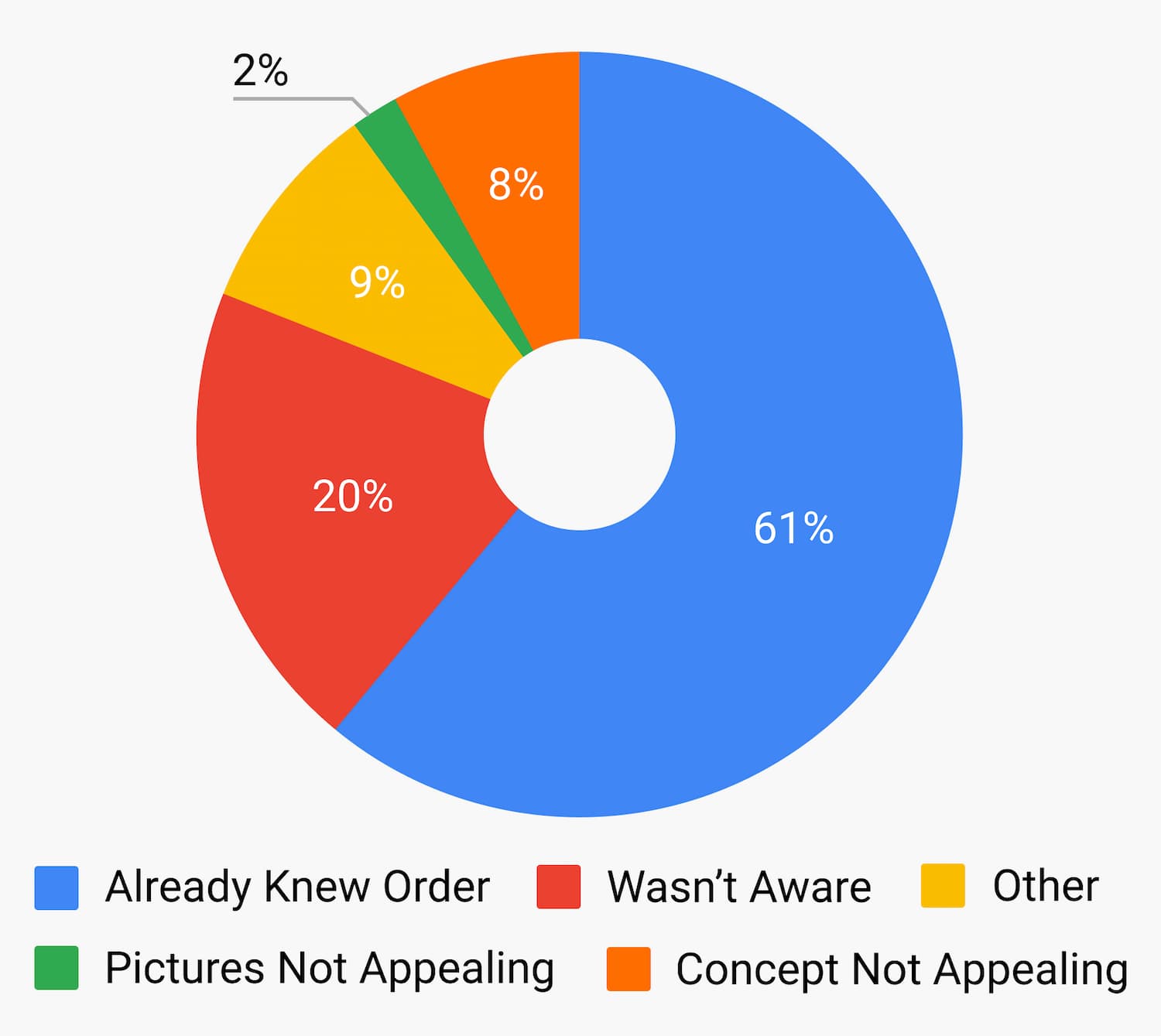

Most people didn’t order the LTO because they already knew their regular orders and didn’t want to try something new. This is followed by people who were simply unaware of the new product.

“I have a gluten and/or dairy allergy and didn’t think these could be made with replacement dough or cheese… ?”

We can drill down into the 9% of guests who chose “Other” through a word cloud analysis. From that, it’s clear that special dietary requirements was a big reason for guests not trying the LTO.

“Incident Involvement Rate” measures how often both an item and the overall experience are rated three stars and below at the same time. You want this metric to be as low as possible.

Fig and Feta currently has the highest incident involvement rate.

As mentioned before, sales data isn’t the true indicator LTO performance — it is the result of many factors: promotional effort, menu placement, food photography, etc. Only when combined with guest satisfaction data can you see the full story.

Let’s put the three variations of the LTO into this simple matrix:

Currently, the biggest issue to be resolved is Pesto Pizzazz. The high sales, low sentiment of that variant means first-time guests are much more likely to hve a bad experience and not come back.

Given that Fig and Feta is the most likely to be modified, if Crust and Co. is adept at customizing guests’ orders, we’d recommend that the chain allow guests to build their own Fig and Feta slice, and allow for minor customizations for the other variations. This can be done through drop-down options in the online ordering app, or allowing dine-in customers to do so with verbal instructions.

Since the survey mix and satisfaction of the LTO decreases after 5:00 PM, we can conclude that guests indeed view the LTO as a great lunch or on-the-go snack. Therefore the LTO achieved Crust and Co.’s primary goal and we recommend keeping the item, as it’s driving traffic during the desired dayparts.

Besides being unaware of the new items, dietary restriction is the biggest reason why people didn’t order the LTO. We recommend offering vegan, dairy-free, and gluten-free options. This could provide a sizable boost in bringing first-time customers to your restaurants.

This pizza brand was able to move away from gut hunches and into the realm of data-driven insights.

Creating such a finely-tuned process could not have been done without the granular feedback metrics collected by Tattle surveys, a staple of over 200+ multi-unit restaurant brands (Chili’s, Hooters, Dave’s Hot Chicken, etc.).